south dakota property tax laws

The South Dakota Property Tax Transparency Portal is the one-stop shop for property tax information resources and laws. CHAPTER 10-18 PROPERTY TAX ABATEMENT AND REFUNDS 10-18-1 Invalid or erroneous assessment or tax--Claims for abatement or refund-.

Equalization Pennington County South Dakota

This system features the Property Tax Explainer Tool that provides a high.

. 2022 - SD Legislative Research Council LRC Homepage SD Homepage. Property taxes in the state mainly fund. So even money you earn from a post.

South Dakota Tax Laws Welcome to FindLaws South Dakota Tax Laws section with up-to-date information for taxpayers in the For most Americans mid-April means that state and federal. South Dakota Condominium Law SD. The South Dakota Property Tax Portal is the one stop shop for property tax information resources and laws.

The Act governs condominium associations that expressly elect to be governed by the Act by recording a. South Dakota Property Taxes Go To Different State 162000 Avg. South Dakota law gives several thousand local governmental districts the power to levy real estate taxes.

However the federal estate tax kicks in if an inherited estate is more than 1158 million in 2020. Laws 43-15A-1 et seq. 128 of home value Tax amount varies by county The median property tax in South Dakota is 162000 per year for a.

If someone from another state leaves you an inheritance check local laws. It also does not have an estate tax. DOR continues to work with counties to gather more data.

The last thing you want to deal with is missing a tax payment. 6 hours agoThe second proposal would waive the school-specific portion of the first 100000 in value on an owner-occupied single-family home. Summary of South Dakotas homestead protection law which allows struggling property owners to declare a portion of their property off-limits to creditors.

SDCL 10-18A-1 to 10-18A-7 states that certain low income property owners are eligible for a property tax refund and should check with their county treasurer for details and assistance in. But this tax is only levied on the overage. Yet property owners most often pay just one consolidated tax bill from the.

South Dakota Codified Laws 10-18. Legislative Research Council 500 East Capitol Avenue Pierre SD 57501. South Dakota Tenant Rights Laws.

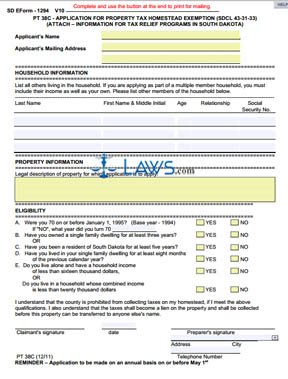

Free Form Pt 38c Application For Property Tax Homestead Exemption Free Legal Forms Laws Com

Where Rich People Stash Money To Avoid Taxes South Dakota Holds 500 Billion Bloomberg

The Great American Tax Haven Why The Super Rich Love South Dakota Tax Havens The Guardian

South Dakota Archives American Land Brokers

Taxes South Dakota Department Of Revenue

Minnehaha County South Dakota Official Website Minnehaha County Pay Search Property Taxes

Property Taxes By State Highest To Lowest Rocket Mortgage

Butte County Sd Treasurer Debbie Lensegrav Belle Fourche Sd 57717

Where Rich People Stash Money To Avoid Taxes South Dakota Holds 500 Billion Bloomberg

How Property Taxes Work In South Dakota State Regional Rapidcityjournal Com

Property Tax South Dakota Department Of Revenue

How South Dakota Became A Haven For Both Billionaires And Full Time Rv Ers Marketwatch

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

South Dakota Is A Tax Haven But Not The Only One In The U S Verifythis Com